B2B Credit Risk Management Best Practices Credit Management System

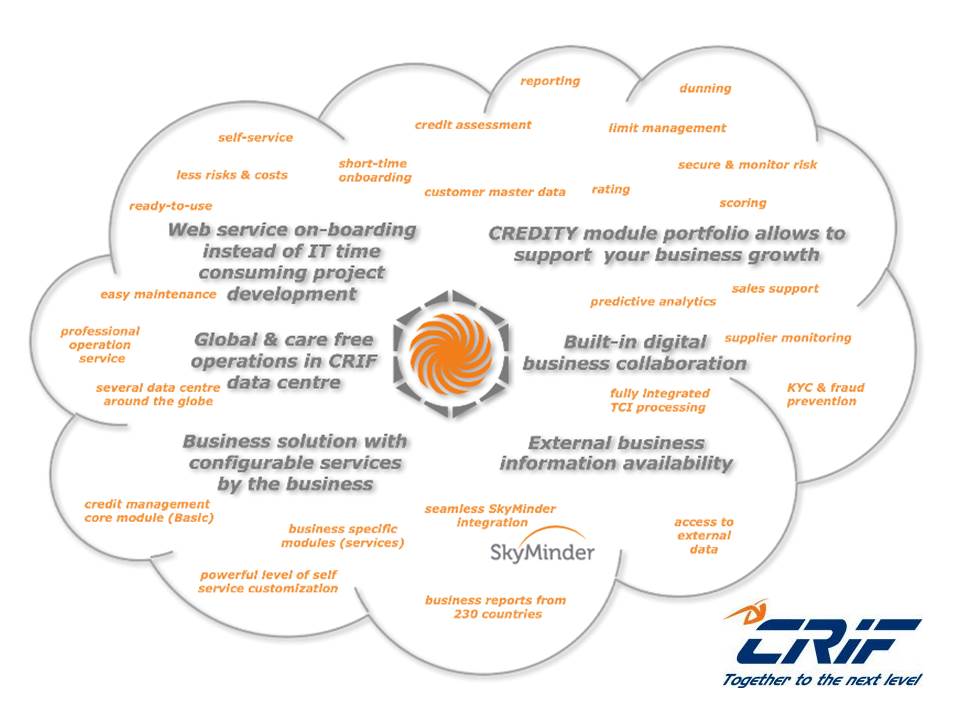

CRIF Germany Launches CREDITY, a new B2B Credit Management Solution

The B2B credit management process steps are aimed at assessing credit risk, setting credit limits, and monitoring payment behavior. Based on the 5Cs of credit, here are the key steps involved in the credit management process:

-18.png?width=900&name=image (1)-18.png)

Top 10 Best B2B Payments Methods [2022 Update]

B2B credit management has become an increasingly intricate process as organizations strive to drive high-quality outcomes while avoiding considerable risks. Manual B2B credit management processes tend to be more subject to human error, deficient in reporting capabilities, and limited in their ability to uncover flaws in existing order-to-cash processes. Utilizing a financial solution software.

Top 15 Parameters Your B2B Credit Scoring Model Must Have

2021 Playbook for B2B Credit Risk Management Built with inputs from 200+ A/R leaders across North America and Europe. Details on the five biggest trends impacting the Credit world and the perfect plays to counter the thread. Contents Chapter 01 The Biggest Credit Trends in 2020 Chapter 02 Adjusting to New Dynamics in Credit Risk Management

Top strategies to dominate B2B credit management

What Are B2B Credit Management Systems? Credit management is an umbrella term for handling loans and payments between companies. With it, you can create company plans for credit card transactions, late payments, customer defaults, and more. For beginning companies, the idea is simple. All you need is a credit system so you can accept payments.

B2B Credit Management Group in India, UAE, UK and SingaporeGroup UCS

How to Simplify and Streamline Your B2B Credit Risk Management Resolve Team What is credit management? Credit management is the process in which a business handles extending credit to potential clients, including verifying their ability to pay, setting net terms, and collecting late payments.

B2B Credit Application A Complete Guide [With Templates]

What is B2B credit management? B2B credit management is a far-reaching term used in accounts receivable to describe the process of collecting payments between companies. Because payment processes can vary widely between businesses, the specific activities included in B2B credit management will depend on your industry.

B2B Credit Management TreviPay

EVO was founded in the U.S. as a national independent sales organization in 1989. With business activities in 50 markets and 150+ currencies around the world, we are now among the largest fully integrated merchant acquirer and payment processors in the world. Simplifying Payments Around the Globe. 150+ currencies across 50 markets worldwide.

B2B Credit Management Best Practices

A B2B credit management system is meant to aid in the processing of payments. To learn more about this, check out NuORDER.

B2B Credit Management System NuORDER

Evolution of B2B Credit Management System Tracing the history of B2B credit management systems reveals a shift from basic features in early ERP and accounting software to today's sophisticated solutions.

B2B Credit Application A Complete Guide [With Templates]

How our B2B credit programs work Capital One Trade Credit helps businesses like yours provide B2B customers with buy now, pay later solutions and the online tools they expect—while supporting you throughout the order-to-cash lifecycle. Podcast: A Platform & A Partner

B2B Credit Management TreviPay

B2B credit management is the process you use to control business credit, oversee accounts receivables management, and handle bad debts between companies. It refers to the entire management process that ensures you stay on top of trade credit.

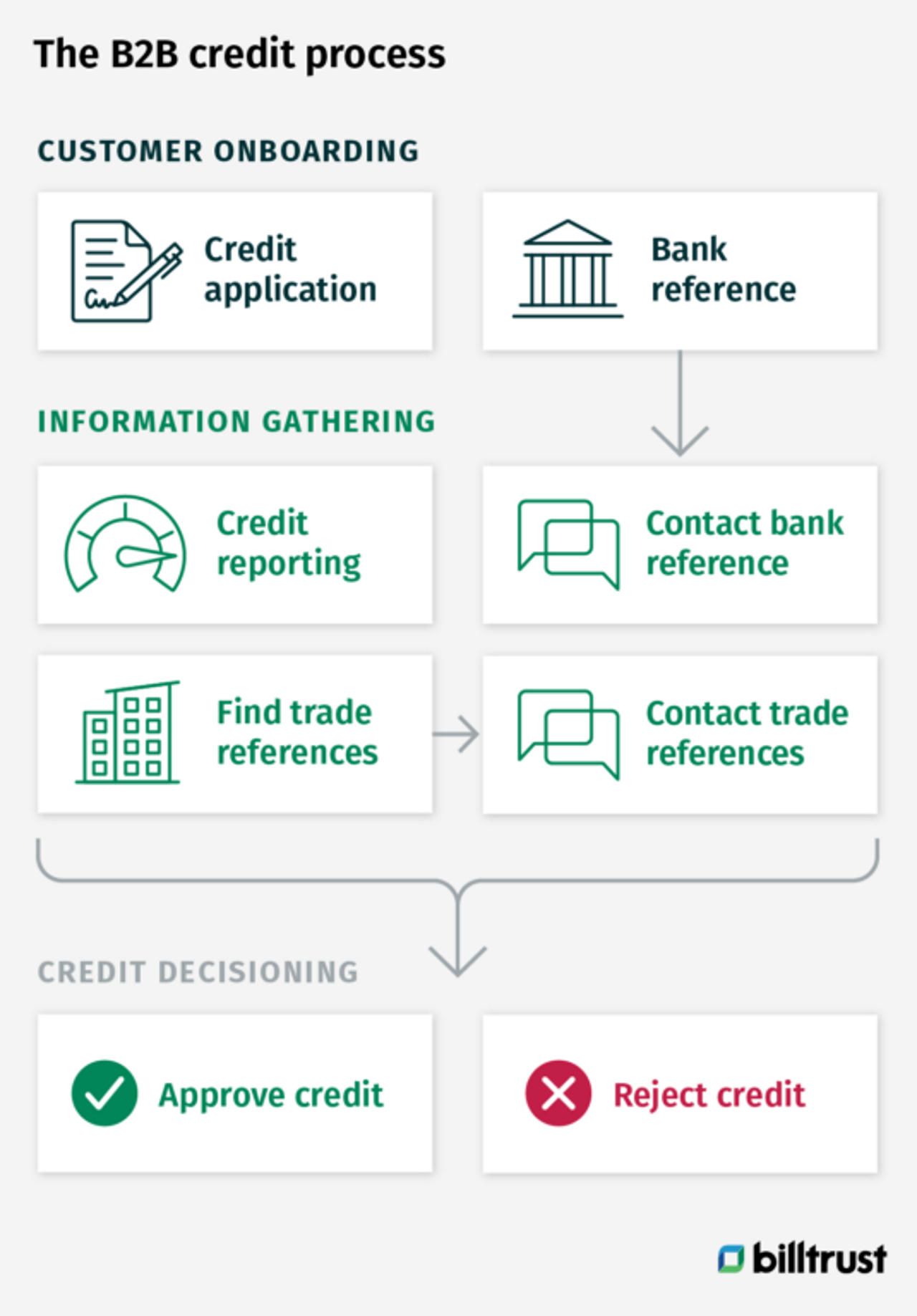

What is credit management, processes and more Billtrust

B2B credit management evaluates other businesses' creditworthiness and determines appropriate credit limits and terms. It encompasses credit assessment, risk analysis, credit monitoring, and collections strategies.

Accepting B2B Payments? Here’s Everything You Need To Know

We will consider the case of a first-time buyer applying for $50,000 in credit. Here are the typical steps involved in the credit application process : Customer completes and submits the credit application. The Credit Department reviews the credit application for completeness and accuracy. The Credit Department requests additional information.

Top strategies to dominate B2B credit management

Credit, Collections & Accounts Receivable Management. Login. Need help logging in?

B2B Credit Risk Management Best Practices Credit Management System

Scale Smarter Request customer credit limits as you grow. We provide the largest credit facilities in invoice finance. Credit Data We process millions of invoices and billions in payments across thousands of businesses every year to make informed, real-time credit decisions about your customers. Transactional Data

Are you making these four B2B credit management mistakes? Liverpool

What is a B2B credit management system? Taking it back to basics, a business-to-business (B2B) credit management system simplifies the process of managing your customer loans and payments. This could include credit card transactions, late payments, customer defaults, and other credit-related issues for a successful business.